By alphacardprocess June 3, 2025

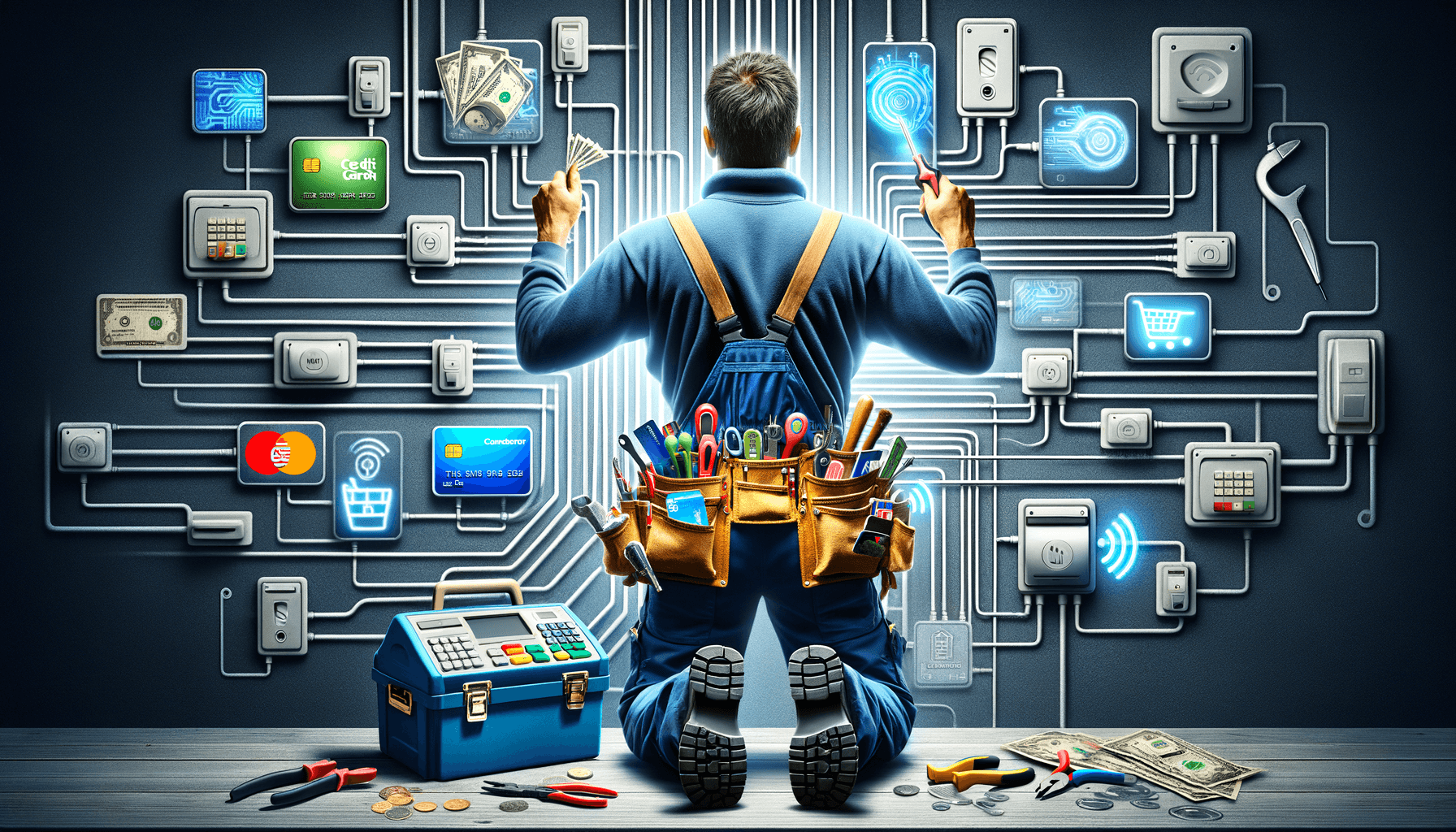

As an electrical contractor, managing multiple payment methods is essential for ensuring smooth transactions with customers. In today’s digital age, offering various payment options is crucial for meeting the diverse needs and preferences of clients. From credit card payments to mobile solutions and online gateways, having a range of payment methods can help streamline your business operations and improve customer satisfaction.

In this comprehensive guide, we will explore the importance of offering multiple payment options, how to set up different methods for your electrical contracting business, and best practices for managing security, compliance, refunds, and chargebacks.

Importance of Offering Multiple Payment Options to Customers

In the competitive field of electrical contracting, providing multiple payment options can give you a competitive edge and attract more customers. According to a survey by TSYS, 56% of consumers prefer to pay with credit or debit cards, while 26% prefer digital wallets like Apple Pay or Google Pay. By offering a variety of payment methods, you can cater to different customer preferences and make it easier for clients to pay for your services.

Moreover, accepting multiple payment options can help you increase sales and revenue. Research shows that businesses that offer more payment methods tend to have higher conversion rates and larger average transaction sizes. By giving customers the flexibility to choose how they want to pay, you can reduce friction in the payment process and encourage more purchases.

Setting Up Different Payment Methods for Your Electrical Contracting Business

When setting up different payment methods for your electrical contracting business, it’s important to consider the needs of your customers and the capabilities of your business. Here are some popular payment options to consider:

1. Credit Card Payments: Accepting credit card payments is a must for any modern business. To set up credit card processing, you will need to partner with a payment processor or merchant services provider. They will help you set up a merchant account, process transactions, and ensure compliance with payment card industry (PCI) standards.

2. Mobile Payment Solutions: Mobile payment solutions like Apple Pay, Google Pay, and Samsung Pay are becoming increasingly popular among consumers. To accept mobile payments, you will need to invest in a compatible point-of-sale (POS) system or mobile card reader. These solutions offer convenience and security for both you and your customers.

3. Online Payment Gateways: Online payment gateways allow customers to pay for your services through your website or a secure online portal. Popular gateways like PayPal, Stripe, and Square make it easy to accept online payments and manage transactions. You can also integrate payment buttons or forms on your website for seamless checkout.

Accepting Credit Card Payments as an Electrical Contractor

Accepting credit card payments can help you attract more customers and increase sales for your electrical contracting business. To start accepting credit cards, you will need to follow these steps:

1. Choose a Payment Processor: Research different payment processors and choose one that offers competitive rates, reliable service, and robust security features. Popular options include Square, PayPal, Stripe, and Authorize.Net.

2. Set Up a Merchant Account: To process credit card payments, you will need to set up a merchant account with your chosen payment processor. This account will allow you to accept card payments, receive funds, and manage transactions.

3. Invest in a POS System: If you have a physical storefront or office, consider investing in a point-of-sale (POS) system that can accept credit card payments. POS systems come with card readers, receipt printers, and software that can streamline transactions and track sales.

4. Ensure Security and Compliance: Protecting customer data and ensuring compliance with PCI standards is crucial when accepting credit card payments. Make sure your payment processor encrypts sensitive information, follows security best practices, and provides fraud protection tools.

Implementing Mobile Payment Solutions for Your Electrical Contracting Business

Mobile payment solutions offer convenience and flexibility for both you and your customers. To implement mobile payment solutions for your electrical contracting business, follow these steps:

1. Choose a Mobile Payment Provider: Research different mobile payment providers like Apple Pay, Google Pay, and Samsung Pay. Consider factors like compatibility, fees, security features, and customer support when choosing a provider.

2. Invest in a Mobile Card Reader: To accept mobile payments in person, you will need a mobile card reader that can connect to your smartphone or tablet. Providers like Square and PayPal offer affordable and easy-to-use card readers that can process transactions on the go.

3. Update Your POS System: If you already have a POS system, make sure it is compatible with mobile payment solutions. Update your software and hardware to support mobile payments and provide a seamless checkout experience for customers.

4. Train Your Staff: Educate your staff on how to accept mobile payments, troubleshoot any issues, and provide excellent customer service. Training your team will ensure smooth transactions and a positive experience for customers using mobile payment solutions.

Managing Online Payment Gateways for Your Electrical Contracting Business

Online payment gateways are essential for accepting payments through your website or online portal. To manage online payment gateways effectively, follow these best practices:

1. Choose a Reliable Gateway Provider: Research different online payment gateway providers like PayPal, Stripe, and Square. Consider factors like transaction fees, integration options, security features, and customer support when choosing a provider.

2. Integrate Payment Buttons or Forms: Add payment buttons or forms to your website to make it easy for customers to pay for your services online. Customize the design, placement, and messaging of these buttons to encourage conversions and streamline the checkout process.

3. Offer Multiple Payment Options: Provide customers with a variety of payment options through your online gateway, including credit cards, debit cards, digital wallets, and bank transfers. Giving customers choices can increase conversion rates and improve the overall shopping experience.

4. Monitor Transactions and Analytics: Keep track of your online transactions, monitor payment trends, and analyze customer behavior using your payment gateway’s reporting tools. Use this data to optimize your payment process, identify opportunities for growth, and make informed business decisions.

Integrating Payment Processing Software for Seamless Transactions

Integrating payment processing software can help streamline transactions, improve efficiency, and enhance the overall customer experience. To integrate payment processing software for your electrical contracting business, consider the following steps:

1. Choose a Payment Processing Software: Research different payment processing software options like QuickBooks Payments, Square, and Stripe. Look for software that offers features like invoicing, recurring billing, reporting, and integration with other business tools.

2. Customize Invoices and Payment Forms: Customize your invoices and payment forms with your branding, contact information, and payment options. Make it easy for customers to pay online, set up recurring payments, and track their transaction history.

3. Automate Payment Reminders: Set up automated payment reminders to notify customers of upcoming due dates, late payments, or failed transactions. Automating this process can save time, reduce manual errors, and improve cash flow for your business.

4. Integrate with Accounting Software: Integrate your payment processing software with your accounting software to streamline financial reporting, reconcile transactions, and track revenue. This integration can help you stay organized, make informed decisions, and manage your finances more effectively.

Ensuring Security and Compliance with Multiple Payment Methods

Ensuring security and compliance with multiple payment methods is crucial for protecting customer data, preventing fraud, and maintaining trust with your clients. To ensure security and compliance with different payment methods, follow these best practices:

1. Encrypt Sensitive Information: Use encryption technology to protect sensitive customer data like credit card numbers, expiration dates, and security codes. Encrypting this information can prevent unauthorized access, reduce the risk of data breaches, and comply with industry regulations.

2. Implement Fraud Prevention Measures: Set up fraud prevention tools like address verification, card verification, and velocity checks to detect and prevent fraudulent transactions. Monitor suspicious activity, investigate chargebacks, and take action to protect your business and customers.

3. Stay Up to Date with PCI Standards: Stay informed about the latest Payment Card Industry Data Security Standard (PCI DSS) requirements and guidelines. Follow best practices for securing payment data, maintaining compliance with PCI standards, and protecting your business from security threats.

4. Train Your Staff on Security Protocols: Educate your staff on security protocols, data protection measures, and fraud prevention techniques. Train employees on how to handle sensitive information, recognize potential security risks, and respond to security incidents promptly.

Handling Refunds and Chargebacks with Different Payment Options

Handling refunds and chargebacks with different payment options is an important aspect of managing multiple payment methods as an electrical contractor. To effectively manage refunds and chargebacks, follow these guidelines:

1. Establish a Refund Policy: Create a clear and transparent refund policy that outlines the terms and conditions for refunds, exchanges, and returns. Communicate this policy to customers upfront to set expectations and avoid misunderstandings.

2. Process Refunds Promptly: Process refunds promptly and efficiently to provide excellent customer service and maintain trust with your clients. Keep accurate records of refunds, issue credit back to the original payment method, and confirm with customers once the refund has been processed.

3. Respond to Chargebacks: If you receive a chargeback from a customer’s bank or credit card issuer, respond promptly with supporting documentation, evidence of the transaction, and any relevant information. Work with your payment processor to resolve the chargeback and prevent future disputes.

4. Monitor Refund and Chargeback Trends: Monitor refund and chargeback trends, analyze the root causes of disputes, and take proactive steps to prevent future issues. Address any recurring problems, improve your customer service processes, and communicate openly with customers to resolve disputes amicably.

FAQs

Q: What are the benefits of offering multiple payment options as an electrical contractor?

A: Offering multiple payment options can increase convenience for your customers, attract new clients, and boost your business revenue.

Q: How can I set up different payment methods for my electrical contracting business?

A: Research payment processors, integrate them into your billing system, and test the payment methods to ensure they are working correctly.

Q: What security measures should I implement to protect customer payment information?

A: Implement encryption, tokenization, and PCI DSS compliance to safeguard sensitive data and prevent fraud.

Q: How should I handle refunds and chargebacks with different payment options?

A: Have clear policies for issuing refunds, processing chargebacks, and resolving disputes with customers to minimize financial risks.

Conclusion

Managing multiple payment methods as an electrical contractor is crucial for ensuring smooth transactions with your customers and growing your business. By offering various payment options, you can cater to the diverse preferences of your clients, attract new customers, and improve the overall efficiency of your billing process.

From accepting credit card payments to implementing mobile payment solutions and managing online payment gateways, there are numerous ways to diversify your payment options and enhance the customer experience.

By prioritizing security and compliance, handling refunds and chargebacks professionally, and providing ongoing support for your payment systems, you can build trust with your customers and drive success for your electrical contracting business. Follow the comprehensive guide outlined in this article to effectively manage multiple payment methods and take your business to the next level.